For decades, the standard financial advice passed down from older generations was simple. You worked hard, you put your money in a local savings account, and you waited for a gold watch at the end of forty years.

But for Millennials and Gen Z in 2026, that script has been completely rewritten. We are seeing a massive departure from traditional “brick and mortar” loyalty. Instead, younger savers are embracing a blend of aggressive digital growth, “loud budgeting,” and a desire for financial tools that move as fast as their social feeds.

Where the money goes today says a lot about the values of the people earning it.

The Shift Toward “Soft Saving” and “Loud Budgeting”

One of the most fascinating money trends this year is the rise of “soft saving.” Rather than embracing an all-or-nothing hustle mentality, Gen Z and younger Millennials are focusing on balancing future security with present-day quality of life.

This shift has gone hand in hand with “loud budgeting,” a social movement where people are increasingly open about setting financial boundaries.

Instead of quietly stressing over money or pretending to afford expensive habits, many are now vocal about choosing lower-cost options in order to prioritize savings. This transparency has helped remove the stigma around frugality and turned saving into something openly intentional rather than restrictive.

As a result, the financial tools people choose need to support this mindset. Accounts that offer competitive interest rates, minimal friction, and simple automation are especially appealing — which is why a SoFi online bank account fits naturally into this approach to modern personal banking.

High Yield as a Non-Negotiable

For younger generations, the interest rate on a standard big bank savings account is essentially a joke.

They grew up in a digital world where information is instant, and they know that keeping money in an account earning nearly zero percent is a losing game against inflation. In 2026, the migration toward high-yield digital institutions is no longer a trend. It is the baseline.

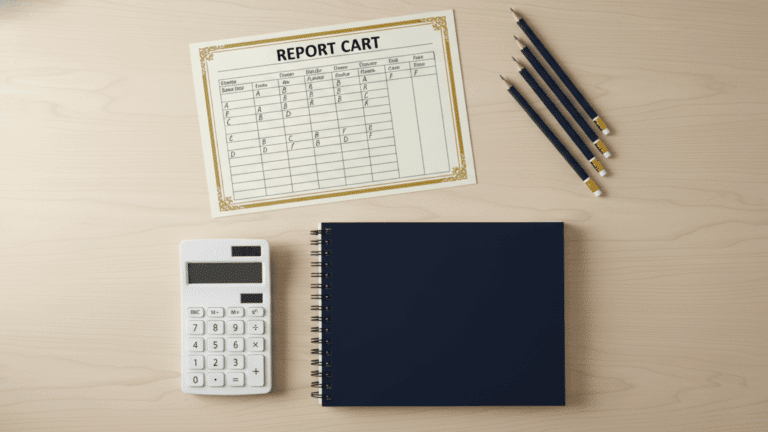

These savers are looking for platforms that offer 3% to 5% returns as a starting point. They view their cash as a tool that should be working for them at all times. This “mercenary” approach to banking means that loyalty is dead.

If a digital platform offers a better user experience and a higher APY, they will move their entire financial ecosystem in an afternoon. The ease of switching accounts has forced the industry to become more competitive, and the younger cohort is reaping the rewards.

The Automation Addiction

Time is the most valuable currency for Millennials and Gen Z. They have zero interest in manually balancing a ledger or visiting a physical branch. This has led to a massive spike in automated financial behaviors.

We are seeing a rise in “set it and forget it” strategies. Whether it is rounding up every purchase to the nearest dollar or setting up automated “sweeps” that move excess cash into investment accounts, the goal is to make wealth building invisible.

By automating the process, they remove the emotional friction of “choosing” to save. It happens in the background, quietly building a safety net while they focus on their careers and personal lives. This reliance on tech-driven tools has also made them more open to AI-managed portfolios.

In 2026, nearly half of Gen Z savers report they are comfortable with an algorithm managing their investments, a stark contrast to the skepticism held by older generations.

Diversification Beyond Stocks and Bonds

The traditional 60/40 portfolio (60 percent stocks and 40 percent bonds) is largely seen as outdated by today’s young investors. They are looking for “alternatives” that don’t always move in lockstep with the stock market.

This includes everything from fractional real estate and private credit to a continued interest in digital assets. They want to own pieces of things they understand and use.

This search for yield has driven them toward platforms that offer access to private markets that were once restricted to accredited investors.

They are diversifying not just to protect their wealth, but to feel more connected to where their money is actually going. There is a strong desire for “values-based” investing, where the capital supports companies or initiatives that align with their personal beliefs on climate change or social equity.

The Death of the Physical Branch

For a Gen Z saver, the idea of waiting for a bank to open at 9:00 AM is almost incomprehensible. They expect their financial partner to be available 24/7 in the palm of their hand.

The “human element” they value isn’t a person behind a counter. It is a seamless user interface, responsive digital support, and a community of peers sharing advice online.

This has led to a decline in physical bank traffic that is reshaping our city centers. The few times a younger person visits a branch are for complex, one-time events like a mortgage closing or a notary service. For everything else, the digital app is the primary relationship. This shift toward “invisible” banking is the hallmark of the 2026 financial experience.

Conclusion

The money moves being made by Millennials and Gen Z today are a reflection of a world that is more connected, more transparent, and more automated than ever before.

They are redefining what it means to be “responsible” with money by prioritizing growth, flexibility, and authenticity. As they continue to enter their peak earning years, the institutions that provide the best digital tools and the most honest value will be the ones that survive. The future of cash isn’t sitting in a vault.

It is moving through a digital ecosystem that is as fast and fluid as the people who use it.