Banking salaries vary widely depending on role, region, and specialization.

From entry-level tellers to high-earning executives, compensation reflects not just a paycheck but growing responsibility and career progression.

Understanding these salary ranges helps banking professionals navigate their career paths and make informed decisions.

This blog breaks down banker salaries across different positions and locations, revealing how experience, education, and specialization impact earning potential in today’s market.

Banking Career Salaries: From Entry-Level to Executive Roles

Banking careers typically begin with frontline roles, such as tellers and junior bankers, and then progress to mid-level positions.

Despite what banker jokes might suggest about easy money in banking, seeing how different career paths compare provides helpful context for understanding this salary breakdown.

| Level | Role | Salary Range | Average Salary |

|---|---|---|---|

| Entry-Level | Bank Teller | $30,000 – $38,000 | $34,000 |

| Junior Banker / Assistant | $35,000 – $45,000 | $40,000 | |

| Mid-Level | Personal Banker | $45,000 – $65,000 | $55,000 |

| Loan Officer | $50,000 – $70,000 | $60,000 | |

| Financial Advisor | $60,000 – $90,000 | $75,000 | |

| High-Level | Senior Banker / Wealth Manager | $90,000 – $150,000+ | $120,000 |

| Investment Banker | $120,000 – $250,000+ | $185,000 | |

| Bank Executive (VP/Manager) | $100,000 – $200,000+ | $150,000 |

While salary can vary by location, performance, and institution, this breakdown gives a realistic view of what to expect at each stage. It highlights how banking offers steady financial growth alongside career advancement.

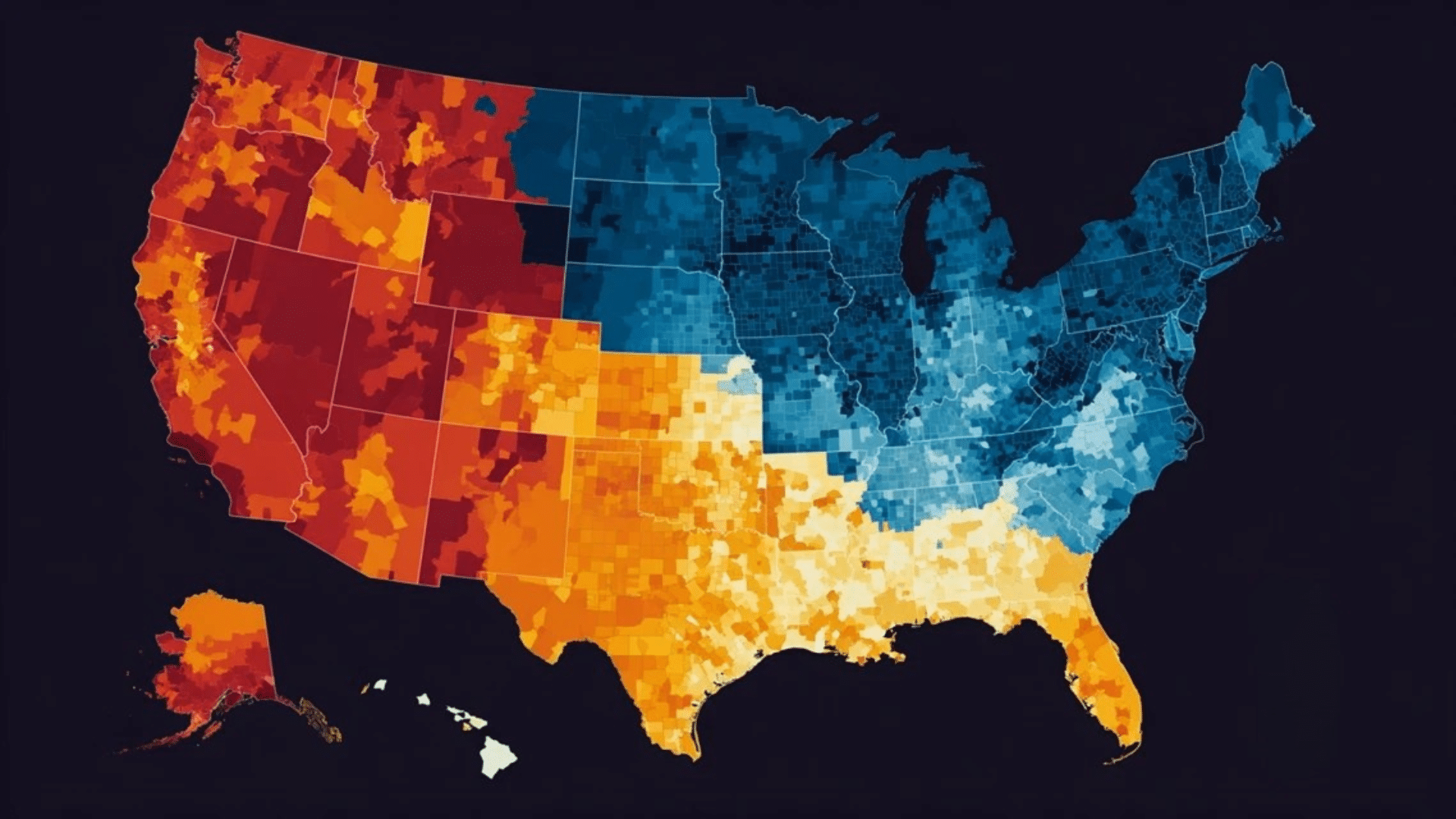

Why Location Matters in Banking Salaries

Location plays an important role in determining banker salaries due to various economic and market factors:

- Cost of Living: Higher living expenses in major cities often lead to increased salary offers.

- Market Size: Large financial hubs have more banking activity, creating demand for skilled professionals.

- Competition for Talent: Banks in competitive markets offer higher pay to attract and retain top employees.

- Industry Presence: Cities with diverse financial sectors, like investment banking or fintech, tend to pay more.

- Regional Economic Health: Strong local economies support better compensation packages for bankers.

Understanding how location impacts pay helps professionals evaluate job offers and career moves more strategically. Next, we’ll examine specific salary ranges across key U.S. regions.

How Salaries Vary by Location

Banker salaries vary enormously by location, with top financial centers offering higher pay to compete with costs of living. Knowing regional salary differences helps banking professionals choose where to develop their careers.

| Region | Salary Range | Notes |

|---|---|---|

| New York | $80,000 – $120,000 | Highest averages, global investment banking hub |

| San Francisco | $75,000 – $110,000 | Tech-driven economy, high cost of living |

| Chicago | $65,000 – $95,000 | Largest Midwest financial center |

| Los Angeles | $60,000 – $90,000 | Mix of retail banking and corporate finance |

| Boston | $70,000 – $100,000 | Strong in investment management and wealth advisory |

| Dallas | $60,000 – $85,000 | Growing banking and corporate lending market |

| Miami | $55,000 – $80,000 | Regional hub, strong international banking links |

| Other U.S. Cities | $55,000 – $80,000 | Smaller markets with lower costs of living |

Regional trends highlight how economic factors and demand influence banker pay. When considering jobs, location, role, and experience are key for maximizing earnings.

Factors That Influence Salary

Banker salaries aren’t determined by title alone. These key factors strongly influence earning potential:

- Experience: The longer you work in banking, the more you earn. Senior staff handle complex accounts, gaining higher salaries compared to entry-level employees.

- Education: Advanced degrees (MBA, finance) or certifications (like CFA) increase salary potential by showing employers specialized knowledge and readiness for higher-paying roles.

- Location: Salaries are higher in financial hubs such as New York or London, where competition, living costs, and demand for skilled bankers are much greater.

- Performance: Bonuses and commissions raise total earnings. Bankers who exceed sales targets or consistently attract new clients often outpace peers with similar base salaries.

- Specialization: Roles in investment banking, wealth management, or corporate finance pay more than retail banking, since these fields require advanced expertise and manage high-value clients.

Conclusion

Banking salaries tend to grow steadily as professionals move up the career ladder, rewarding not only experience but also education and performance.

Starting as a teller or junior banker provides foundational knowledge and skills that open doors to mid-level roles with increased responsibility and pay. For those aiming high, leadership and specialized positions like investment banking offer notable financial rewards.

While the path may require dedication, continuous learning, and skill development, banking remains an industry that combines job stability with strong earning potential.

With the right mix of ambition and expertise, a career in banking can be both personally fulfilling and highly lucrative.