When it comes to making career decisions, there’s no shortage of factors to weigh. Passion for the work, company culture, and the possibility of growth, these are all important. But let’s be real for a second: earning potential might be the one factor that should carry a little more weight than the rest. After all, how many of us would love to do something we love, while making a solid income that lets us live comfortably? If you don’t consider earning potential, you might be missing out on making choices that set you up for financial stability and long-term success. So, let’s dive into why earning potential should be front and center in your decision-making process.

Understanding Earning Potential

First things first, let’s break down what we mean by earning potential. Simply put, it’s the ability to earn a specific amount of money in a given career or job over time. Your earning potential can vary based on a few key factors, like the industry you’re in, the role you take on, where you’re located, and how much experience you have.

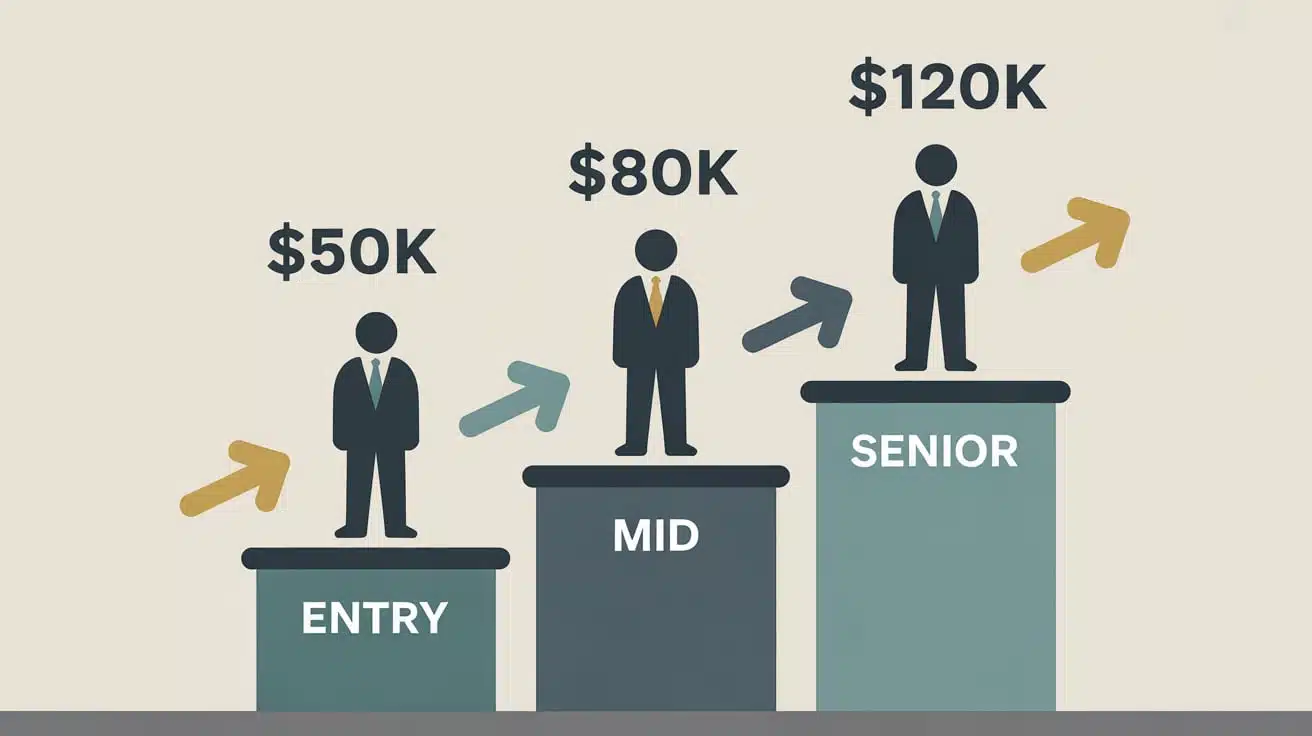

But what does this all mean for your future? Think about it this way: some jobs will cap out at a certain salary, while others might offer opportunities to grow and increase your income over time. Even if the starting salary isn’t much, some fields (like tech or healthcare) have enormous growth potential, meaning you could be making six figures within a few years of climbing the ladder.

So, before you jump into a career just because it sounds fun or interesting, make sure you’re also looking at how much it could pay you, not just today, but five or ten years from now.

The Impact of Education on Earning Potential

Let’s talk education for a second. You’ve probably heard the saying, “The more you learn, the more you earn,” and it’s not just a catchy phrase. Your education plays a huge role in determining your earning potential, especially when it comes to certain career paths.

If you’re aiming for high-paying fields like law, medicine, or engineering, you’ll likely need more than just a bachelor’s degree. You might need a specialized degree, certifications, or even years of schooling. But here’s the thing: the more education and specialized knowledge you have, the higher your earning potential is likely to be.

Let’s take a quick example: a nurse with a bachelor’s degree might start at a solid salary, but a nurse practitioner, who has additional education and training, can earn a lot more. And it doesn’t stop there. Some of the highest-paying college majors open doors to careers where the salary could easily exceed six figures within just a few years.

So, if you’re considering a career that demands higher education, remember that while it might require a bigger upfront investment, the return can be pretty impressive in terms of earning potential.

Long-Term Financial Goals

Here’s where the rubber meets the road: your career choice should support your long-term financial goals. Why? Because without financial security, even the most fulfilling job might end up feeling like a struggle. Having a career with strong earning potential can make it easier to buy a home, pay off student loans, save for retirement, and handle those pesky unexpected expenses (we all know how life loves throwing curveballs).

For example, let’s say you’ve always wanted to work in the arts. It’s an amazing field, and if you’re passionate about it, go for it! But let’s be honest—if you’re in a job that doesn’t pay well and leaves you stressed about money, your job satisfaction will probably start to fade fast. On the flip side, choosing a career that has a higher earning potential, whether it’s in business, tech, or healthcare, could offer you the financial flexibility to enjoy the things that matter most in life, like traveling or saving for your kids’ education.

Ask yourself: could you live comfortably on your starting salary? And what about ten years from now?

Growth Opportunities and Job Security

You can’t talk about earning potential without considering career growth. The good news is that some fields are absolutely bursting with growth opportunities. Take tech, for example. The demand for software developers, data scientists, and cybersecurity experts is skyrocketing, and it’s not just about starting salaries. These industries offer tons of room for career advancement, which often translates to higher pay and more responsibility.

Now, let’s look at job security. Some careers may offer excellent earning potential, but if the industry is shrinking, you might find yourself out of luck in a few years. A job in a declining field may offer good pay now, but it could also be risky in the long term. That’s why industries like healthcare, technology, and renewable energy are often touted as some of the best places to be if you want to secure a solid income for years to come.

Want to be sure your earning potential stays strong? Look at industries that are growing and show no signs of slowing down. It’s all about long-term stability and the opportunity to continue building your career.

Work-Life Balance and Job Satisfaction

Here’s where it gets tricky, earning potential isn’t just about the money. We all know that higher-paying jobs often come with higher stress levels, longer hours, and a tighter schedule. That can seriously impact your work-life balance.

So, is earning potential worth it if it means sacrificing time with your family or having less flexibility to enjoy life outside of work? It’s a tough question. But in today’s world, more and more companies are recognizing the importance of work-life balance and are offering better flexibility for employees—especially in higher-paying fields like tech and remote jobs.

That being said, there’s still a lot to consider. If you’re someone who values personal time and doesn’t want to give up your weekends or evenings, you might want to weigh whether the earning potential of a high-stress job is really worth it. Some people thrive in fast-paced environments, while others might burn out quickly.

So, think about your priorities. What’s more important to you: financial freedom or a job that allows you to maintain a strong work-life balance?

Evaluating Salary Offers and Benefits

When it comes time to evaluate job offers, salary isn’t the only thing to consider. While a higher salary can certainly be enticing, remember to factor in the full package, including benefits, bonuses, and perks. These can make a huge difference in your overall financial situation.

For example, does the job offer health insurance, retirement contributions, or a flexible work schedule? Some jobs may offer a slightly lower salary but come with benefits that more than make up for it. Don’t just look at the numbers—think about the big picture. As you gain experience, is there the possibility of bonuses or raises? Do you have access to professional development opportunities that could enhance your earning potential in the long run?

Investing time in assessing the entire compensation package can assist you in making a decision that aligns with your financial objectives and personal requirements.

Conclusion

Ultimately, when it comes to career decisions, earning potential is something you just can’t ignore. Sure, it’s important to choose a path that aligns with your passion and values, but if you’re not considering the financial implications, you might find yourself in a tough spot later on. By taking into account not only the salary but also growth opportunities, job security, education, and work-life balance, you’ll be in a much better position to make an informed decision about your future.